Portfolio allocation calculator

The portfolio manager would handle those funds and change asset allocation accordingly. The simplest definition of a portfolio is a.

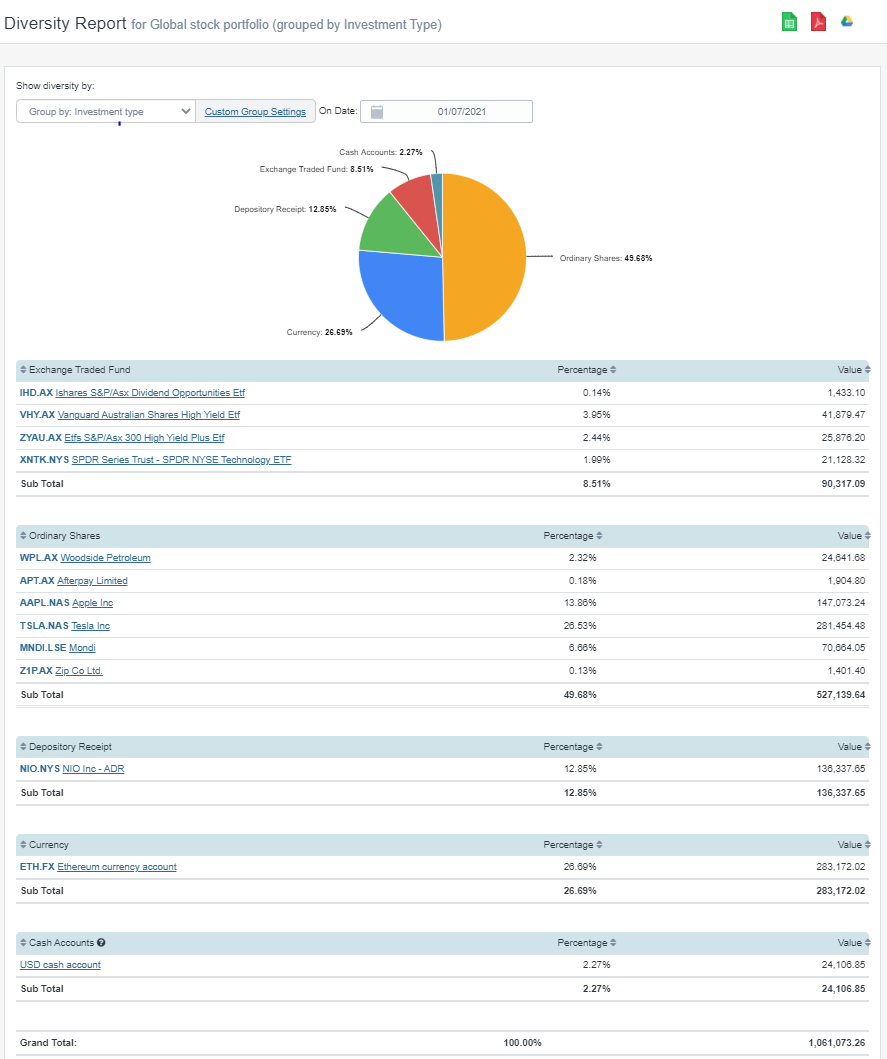

Calculate Your Investment Portfolio Diversification With Sharesight

Python quantitative trading strategies including VIX Calculator Pattern Recognition Commodity Trading Advisor Monte Carlo Options Straddle Shooting Star London Breakout Heikin-Ashi Pair Trading RSI Bollinger Bands Parabolic SAR Dual Thrust Awesome MACD - GitHub - je-suis-tmquant-trading.

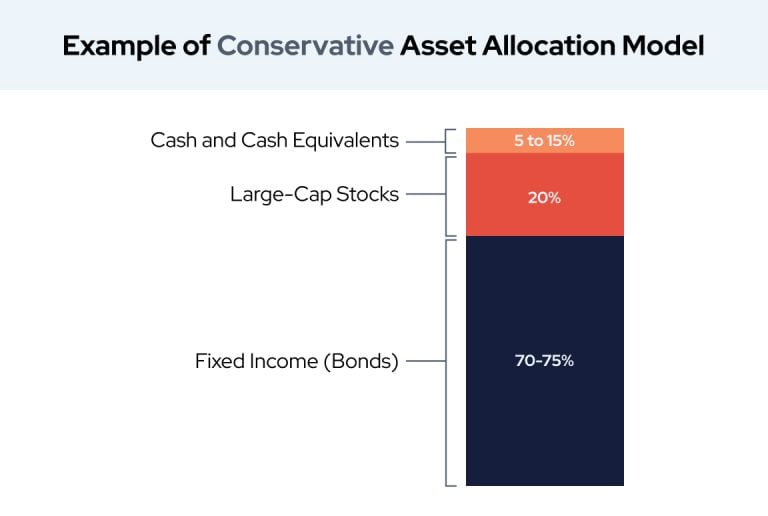

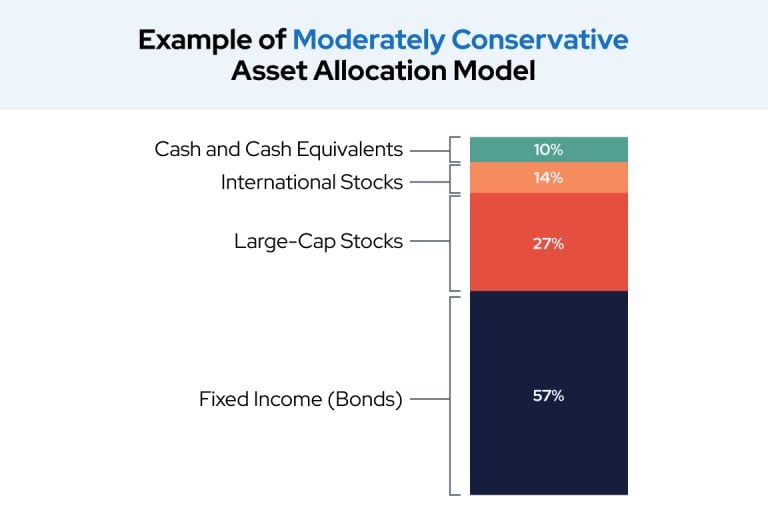

. Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. The historical returns for bonds is between 4 - 6. This Asset Allocation provided herein is purely derived out of mathematical calculations for illustrative purpose only and developed considering various risk tolerance level asset classes and product offered by Quantum Mutual Fund on a.

Start tracking your investments in stocks mutual fund gold bank deposits property and get all. You would withdraw 40000 in your first year of retirement. We use a Monte Carlo simulation model to calculate the expected returns of 10000 portfolios for each risk.

Planning for retirement involves countless considerations from deciding when to take Social Security to. Good fundamental investing is all about maximizing return while minimizing risk. Buy Car Calculator.

They have an Investment Policy Statement commonly called IPS which shall have a predetermined rate of return Rate Of Return Rate of Return ROR refers to the expected return on investment gain or loss it is expressed as a percentage. Plus review your projected RMDs over 10 years and over your lifetime. A portfolio is one of the most basic concepts in investing and finance.

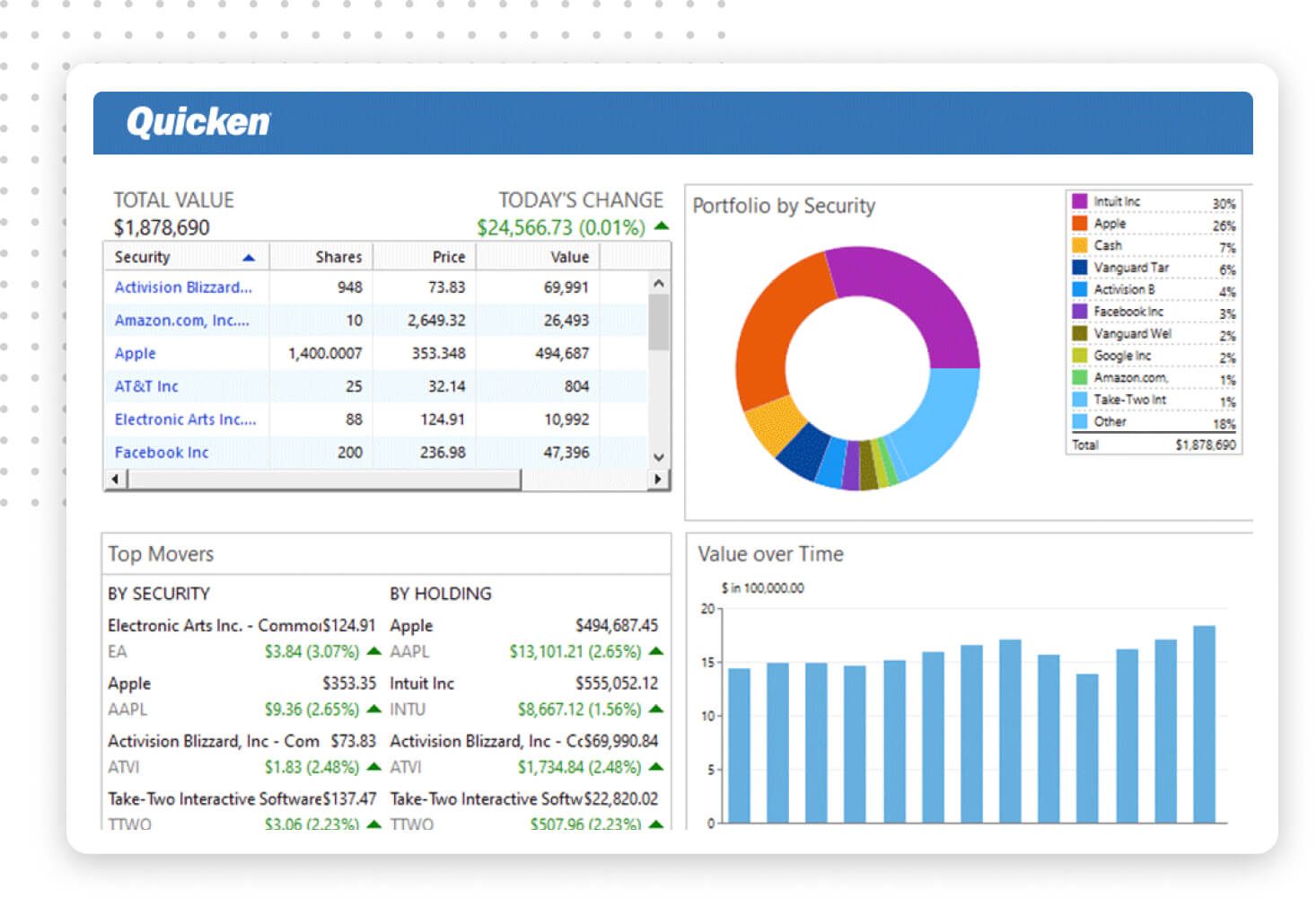

We use historical returns and standard deviations of stocks bonds and cash to simulate what your return may be over time. For example a portfolio consisting of 100. Portfolio - shows all your investments on one page divided into investment type News - official announcements for your shares general news will be added later Allocation - see at a glance the.

If the cost of living rises 2 that year you would give yourself a 2 raise the following year withdrawing 40800 and so on for the next 30 years. Its a term that can have a variety of meanings depending on context. Warren Buffett current and past portfolio holdings.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. This portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds ETFs and stocks. Backtest Portfolio Asset Allocation.

Each blue line represents the individual portfolio-depleting withdrawal rates for a single retirement start date and shorter lines are from start dates less than 40 years ago. Get 247 customer support help when you place a homework help service order with us. The portfolios were distributed five days after the state government comprising Shinde-led Shiv Sena faction and the Bharatiya Janata Party BJP inducted 18 ministers during the first cabinet.

CIBC Smart Investment Solutions are modern all-in-one investment solutions designed for your individual investment goals and life stage. This portfolio backtesting tool allows you to construct one or more portfolios based on the selected asset class level allocations in order to analyze and backtest portfolio returns risk characteristics drawdowns and rolling returns. Backtest Portfolio Asset Class Allocation.

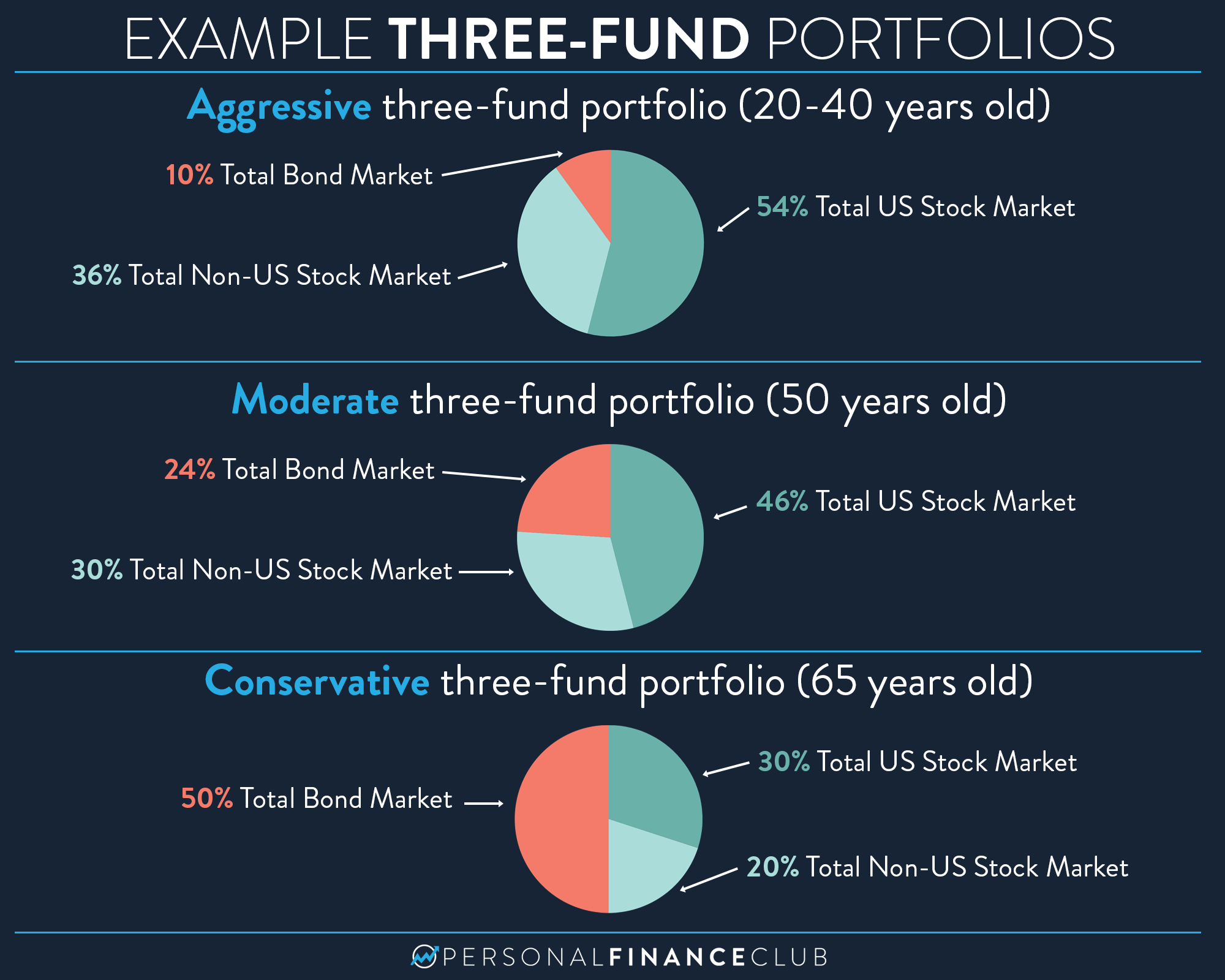

You should also understand the historical returns of different stock and bond portfolio weightings. The 1 Rule For Asset Allocation. The results cover both returns and fund fundamentals based portfolio style.

The orange line tracks the worst-case withdrawal rates also called the Safe Withdrawal Rate of the entire dataset and for start dates less than 40 years ago it also projects future withdrawal rates. Click here to track and Analyse your mutual fund investments Stock Portfolios Asset Allocation. Learn about diversification asset allocation rebalancing risk and other aspects of portfolio management.

Use our RMD calculator to find out the required minimum distribution for your IRA. Diversify your Mutual Fund Investment Portfolio across asset classes with our tried and tested 12. Python quantitative trading strategies.

Start tracking your investments in stocks mutual fund gold bank deposits property and get all. A dually registered investment advisor and broker-dealer. You can analyze and backtest portfolio returns risk characteristics style exposures and drawdowns.

Vanguard offers data on the historical risk and return of various portfolio allocation models based on data from 1926 to 2018. The 25x Rule helps you estimate the total amount of money you need to save for retirement. Roth Conversion Calculator Methodology General Context.

Your portfolio is carefully crafted based on strategic asset allocation and optimally blends both active and passive investments. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan. Asset allocation is the act of diversifying your overall investment portfolio by distributing your assets into a variety of classes.

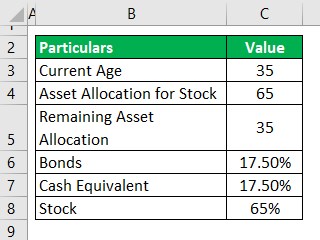

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional rollover SEP andor SIMPLE IRAs into a Roth IRA but it is intended solely for educational purposes it is not designed to provide. For example if youre 30 you should keep. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks.

This is done to limit the risk to your investments if a particular class happens to fall but it allows you to take advantage of the potential returns of riskier asset classes. To do so requires an understanding of your financial objectives and your risk tolerance. Click here to track and Analyse your mutual fund investments Stock Portfolios Asset Allocation.

The historical returns for stocks is between 8 - 10 since 1926. Learn more about CIBC Smart Investment Solutions. Portfolio management services are provided by Charles Schwab Investment Advisory Inc.

The SEC filings include form N-PORT and form N-PORTA which are filed by registered management investment companies and exchange-traded funds ETFs organized as Unit Investment Trusts. You can compare up to three different portfolios against the. For example lets say your portfolio at retirement totals lets say your portfolio at retirement totals 1 million.

Get all the latest India news ipo bse business news commodity only on Moneycontrol. Asset Allocation Mutual Funds.

Asset Allocation Calculator Investonline

Asset Allocation The Ultimate Guide For 2021

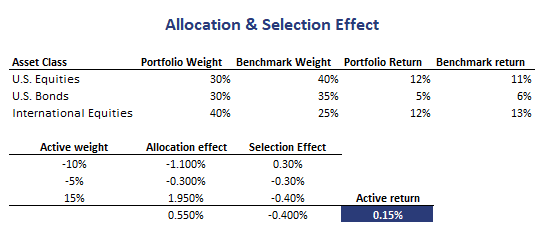

Allocation Effect Implementation In Excel

What Is Asset Allocation How Is It Important In Investing

Quicken Investing Management Software Track Your Investments Today

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)

How To Achieve Optimal Asset Allocation

5 Reasons Why Asset Allocation Is Important For Your Financial Goals

How To Maintain Proper Asset Allocation With Multiple Investing Accounts

The Best Free Asset Allocation Spreadsheet Valuist

The Proper Asset Allocation Of Stocks And Bonds By Age

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Bankrate Calculator Best Sale 57 Off Www Wtashows Com

An Open Source Tool To Calculate The Overall Performance Of An Investment Portfolio Across All Accounts

Asset Allocation The Ultimate Guide For 2021

What Is Asset Allocation How Is It Important In Investing

Three Fund Portfolio Personal Finance Club

Asset Allocation Calculator Allocate The Assets Using Thumb Rule